DMU PrestaShop eco-furniture module, eco-furniture tax

Compatibility :

PrestaShop v1.6 - v8.2.1

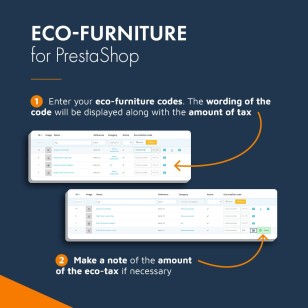

The chore of listing prices and declaring eco-taxes has finally been made easier!

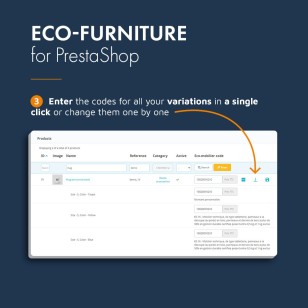

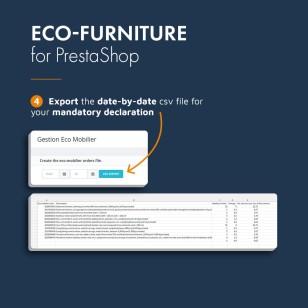

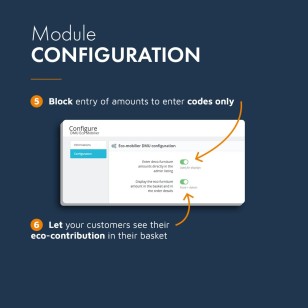

This module lets you manage your eco-furniture codes directly in the administration of your PrestaShop website.

Charges are then automatically calculated and regularly updated according to the code database supplied by the Ecomaison organization (formerly Éco-mobilier).

Compatibility

PrestaShop v1.6 - v8.2.1

Similar products

PrestaShop v1.5 - v8.2.1

PrestaShop V1.6.0.4 - V8.2.1